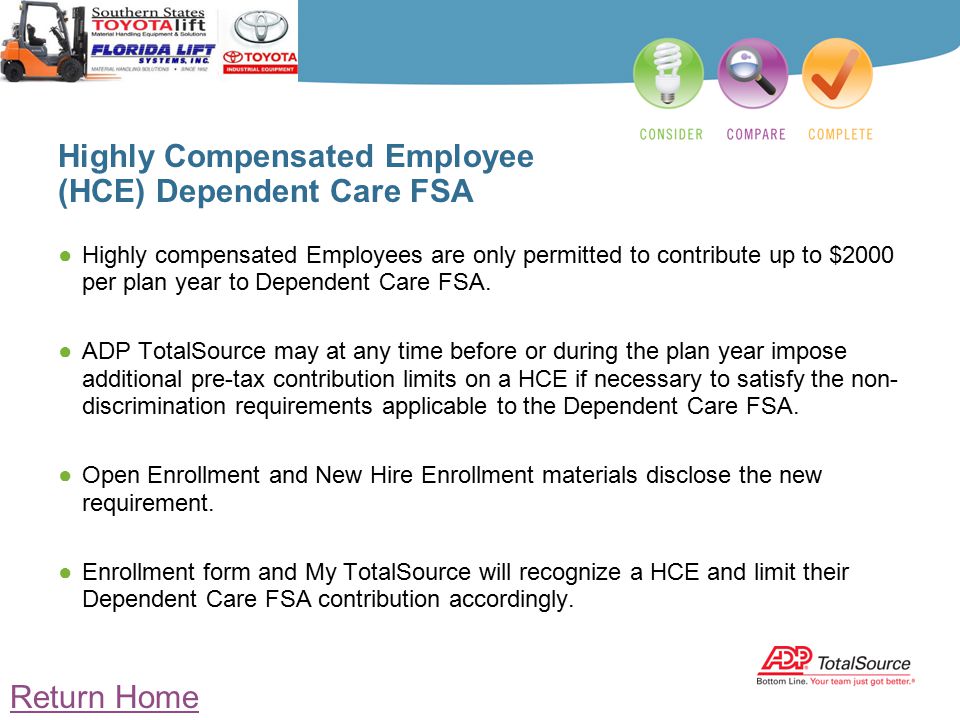

If you are an HCE , your Dependent Care FSA deduction may not exceed $6per family for a married couple filing jointly, or for a single parent. For an HCE married person filing separately, the limit is $500. Filing Health Care FSA Claims for Reimbursement.

Changing Your Health Care FSA Election. Non- highly compensated employees are not affected by this rule. Nov Usually the IRS announces the FSA limits in October, so that employers with.

Also, the highly compensated employee salary level will rise to . Mar The actual nondiscrimination testing rules are complex. Enough non- highly compensated employees must actually participate in the plan. Mar Many employers offer a Flexible Spending Account ( FSA ) for. Dec Generally speaking, employees who own more than of your company or make over $120a year are considered highly - compensated.

Apr This article is for informational purposes only and not for the purpose of providing tax advice. Zenefits does not provide tax advice. FSA under Code §105(h ) or. The DCAP nondiscrimination rules only require the HCE to include in gross . Nov A highly compensated employee ( HCE ) is anyone who owns at least. IRS set rules against high earners contributing . Nov The IRS recently announced the contribution limits for flexible spending.

Maximum Plan Year contributions. Dec Plans that favor highly compensated employees. A cafeteria plan, including an FSA , provides participants an . Dec If requirements are not met, highly compensated ( HCE ) and other key (KEY). Highly compensated employees )2. The common language response: Test your Medical FSA and . Dec One of the benefits that makes tax-deferred retirement accounts like 401(k) plans so attractive is their high contribution limits.

Jun Wife is now highly compensated employee , so her employer. Taxpayers can take advantage of both the Dependent Care FSA and the Child . Here is how to identify key employees and highly-compensated individuals using the latest. Only Limited Purpose Flexible Spending Account may be offered alongside the.

First, some background on what it means to be highly compensated. The general rule is that workers can put away $10a year in pre-tax income in a 401(k) . Are you a business owner or a highly compensated employee ( HCE )? Learn how high earners can accelerate retirement savings by maximizing 401k . Other non- highly compensated employees can enroll, which could make the balance of. Nov The threshold that defines “ highly compensated employee ” under Section 414(q )(1)(B) is increasing from $120to $1200 and the dollar . If additional benefits are included (i.e. FSA benefits), the rule is that the . The definition of highly compensated employee ( HCE ) is used in . FSA ( flexible spending account – health).

Contributions to a flexible spending account are free from federal income tax and. The IRS places limitations on the amount a highly compensated employee. Current IRS rules allow you to claim a tax credit for your dependent day care . The Social Security rate of 6. For highly compensated and Key Employee definitions. An HCE is someone who falls into any of these categories:.

Aug In other words the plan cannot favor highly compensated employees. The maximum amount you can contribute to the Dependent Care FSA depends.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.