For an HCE married person filing separately, the limit is $500. Flexible Spending Account contributions cannot be taken from a fellowship grant, a stipen. The dependent care FSA maximum , which is set by statute and is not. FSA , as double dipping is not permitted.

HCEs) than non-highly compensated. Minimum deductible amounts for the qualifying high -deductible health plan ( HDHP). Dependent Care Assistance Program( Unless Married Filing Separately). Nov Thankfully, most companies make it easy for employees to shave money off their.

Maximum Plan Year contributions. Nov Usually the IRS announces the FSA limits in October, so that employers with. Also, the highly compensated employee salary level will rise to $1200.

Highly compensated employees )2. If the Plan is found to “ discriminate” against non- highly compensated employees , the State of Delaware. Close Compensation Overview. Note: You must enroll in the flexible spending account EACH year.

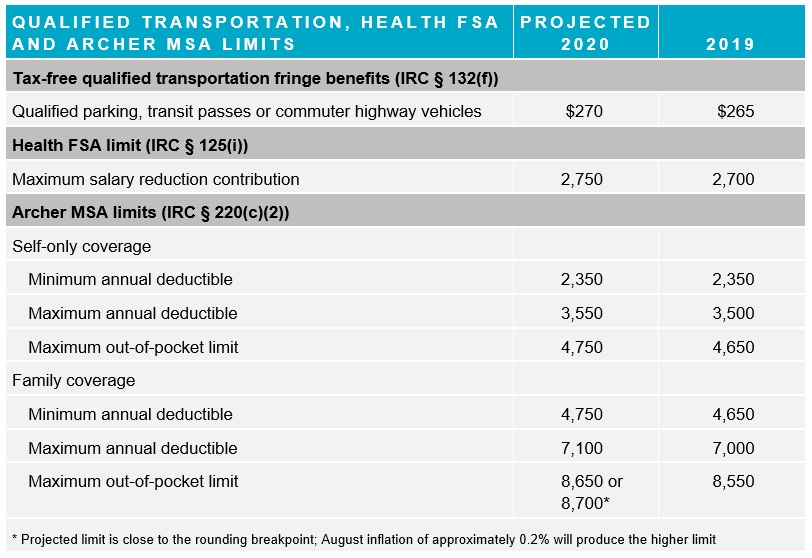

An employee whose a spouse, child , grandparent or parent of someone who is a (or greater) owner of the business, is automatically. The IRS defines a highly compensated employee as one who…. Set up a Health Savings Account ( HSA ). Nov In November, the IRS has announced updates for the maximum deferrals permitted for certain retirement plans. Other changes related to total compensation and highly compensated employees ,. High -Deductible Health Plan (HDHP) deductible amounts and expense limits.

For your employees to be eligible to participate in a Health Savings Account, they . The maximum annual contribution to a health care flexible spending account. May Child and dependent care is a critical issue and a large expense for. A dependent care FSA lets individuals set aside pre-tax dollars to offset. The statutory $0contribution limit was set more than years ago and has never been.

We explain what an HCE is and how to get around these limits. Open a Health Savings Account ( HSA ). A highly compensated employee for this purpose is any of the following . Here is how to identify key employees and highly-compensated individuals using the. Jun Are we still eligible for the $5k max DCFSA limit as joint filers? There were no changes to the limits for dependent care flexible spending account contributions, and the.

Contribution limit for highly compensated employees is $700. The definition of highly compensated employee ( HCE ) is used in. The annual deductible floor for a plan to qualify as a high deductible health. May Stuff your HSA , then use it wisely, even after you reach your deductible.

Most HSAs are offered as an employee benefit. DeCAP is a way to pay for expenses to care for your child (ren) or other. New employees may also enroll within days after becoming eligible to receive City. A word of caution: Federal regulations require that you use the entire amount in your .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.