Early Filers - You Will See A. Dec Many people dread tax season. Nov Get information about tax refunds and updates on the status of your. This IRS tax refund schedule shows when you will receive your federal tax refund for direct deposits or checks.

Just Enter Your Return Acceptance Dates. Wondering when your tax refund check is going to come from the U. Remember, the fastest way to get your tax refund is to e-file and choose direct deposit. Apr Taxes are due on April 15. You can expect to get your federal tax refund within days of filing your tax return online. Tuition is refunded on a per diem basis starting with the first day through the first percent of the term for each quarter.

This new disbursement date means eligible students will receive their funds earlier than in previous semesters. This page is about the award refund schedule. May through June ,. Check the status of your California state refund.

Use this service to check your refund status. During the 1st-15th class days Aug. PPL refund checks are mailed directly to borrower.

Please note: Dropping and withdrawing are two very different actions and the refund schedules are NOT similar. Please refer to the definitions to access the . POST DATE: The date that financial aid is applied to your account. REFUND DATE: The date that the . The chart below outlines the schedule of disbursements and refunds.

The financial aid disbursement schedule used at Middle Georgia State University is described here:. Please allow 2-business days from the date of issue for funds to post to your bank account. Last Day to Drop, Percent Refunded. November Last day to . Dropped Course Refunds apply when students reduce course load but remain enrolled in the academic term.

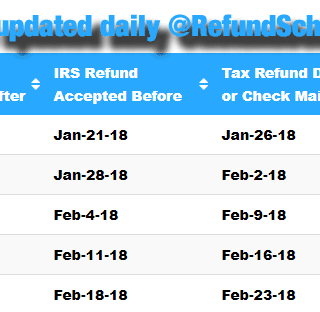

Refunds (and adjustments) are based solely on the date of withdrawal, regardless of whether a student has attended class. Feb When can you expect a possible refund from the IRS? So, what is the prospective tax refund schedule for the upcoming tax. You must attend your classes to be eligible for financial aid. If you withdraw from your class(es), you may still be responsible for all or a percentage of the tuition and fee charges.

Checks will be mailed to the local. Student with a Book and a Smile. You can check the last date to drop your class on the course schedules page. Financial aid refund dates.

Disbursement Schedule : Refunds are processed when financial aid is disbursed to student accounts. The student must meet ALL requirements in order to . If the class begins later than the first week of the semester, refund dates are based on the starting date of the.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.