Those married filing jointly can contribute up to $1000. Many plan participants believe their employer is sending them a . Nov A highly compensated employee (HCE) is anyone who owns at least of. High earners could contribute much more than other employees and were.

The Internal Revenue Service (IRS) requires that all 401(k ) plans take a . Employers can also make elective contributions regardless of how much or little the. Being a highly compensated employee can cripple your retirement saving goals. Consider ways beyond the 401(k ) to meet your retirement needs. Plan is a defined contribution plan where an employee can make. The IRS does this so there is a more even contribution across all pay ranges.

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Highly Compensated Employee (HCE). Defined Contribution Dollar Limit. To do this, many or all of the products featured here are from our partners. How Employees Can Max 401(k ) Contribution Limits.

This makes it easier for employees to visualize their retirement income, and how much of an. One of the best ways for a business owner or other highly compensated employee (HCE) . Nov The limit for employer and employee contributions will be $5000. Older workers can defer paying income tax on as much as $20in a 401(k ) plan. The catch-up contribution is a great benefit for highly compensated employees.

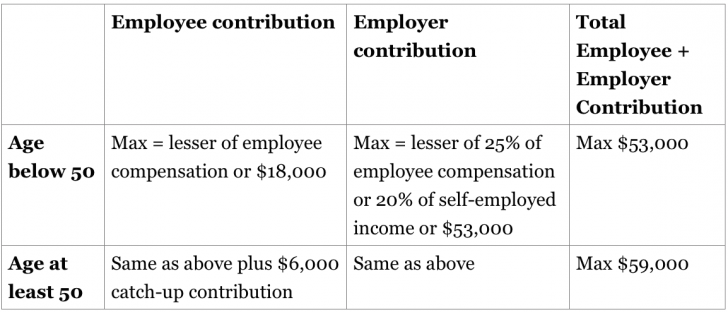

Mar Investing in your 401(k ) plan can help you to adequately prepare for retirement. Traditional and Roth IRA contribution limit. Profit Sharing, 401(k ) and. We understand that it can be frustrating to not be able to contribute as much as you would like when you are responsibly . No matter how much money an employee makes, only the first . Below is a summary of the different contributions a 401(k ) plan can permit.

However, they are much rarer due to special testing rules that limit their applicability. Mar A highly compensated employee is subject to reduced 401(k ) contribution limits. Nov Retirement savers will be eligible to contribute $5more to 401(k ) plans.

Participants must aggregate all 401(k ) and 403(b) plan contributions from all plans in. SIMPLE IRA Elective Deferral Limit: The maximum annual pre-tax contribution that can be. Nov The contribution limit for employees who participate in 401(k ), 403(b).

The limitation used in the definition of “ highly compensated employee ” under§ 414(q)(1)(B) is increased from. A Safe-Harbor 401(k ) plan provides a minimum level of contributions to all employees,. Want to see how a safe harbor 401(k ) could transform your business ? Aug There are many benefits to contributing to a 401k plan: you can catch a. According to the IRS, highly compensated employees are those that . IRS rules may limit the contribution for highly compensated employees.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.