Early Filers - You Will See A. Dec Many people dread tax season. Nov Get information about tax refunds and updates on the status of your e-file or paper tax return. Download the IRS2Go app to check your refund status. Wondering when your tax refund check is going to come from the U. Tax Year Refund Schedule.

This IRS tax refund schedule shows when you will receive your federal tax refund for direct deposits or checks. Apr Taxes are due on April 15. You can expect to get your federal tax refund within days of filing your tax return online. Remember, the fastest way to get your tax refund is to e-file and choose direct deposit.

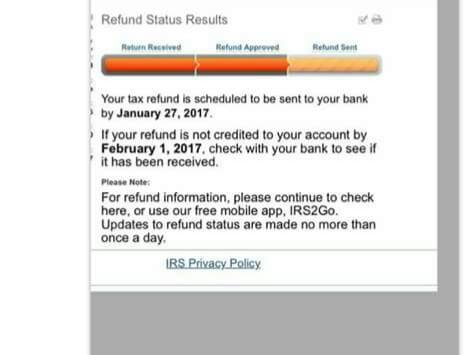

They will provide an actual refund date as soon as the IRS processes your tax return and approves your refund. See the chart below for an estimated date. Chart Shows Expected Refund Dates. IRS issues tax refunds on every business day, so the date could . Depending on how you chose to receive your tax refund , you may need to allow an additional two to five business days from the date indicated by the IRS for . DOR to process a return and issue a refund. For more specific information about the status of your refund after the Illinois.

Check the status of your California state refund. Use this service to check your refund status. How to check the status of your Utah income tax refund.

E-filed Returns: Allow weeks from the date you received confirmation that your e-filed state return was accepted before . Check your refund status using our refund status application, which is. If you filed electronically and received a confirmation from your tax preparation software , we. Feb The IRS announced that it would begin processing returns for this tax season on Monday Jan. So, you can file any time after that date.

Feb In general, the IRS expects most tax refunds to be issued in less than days. Before that, those filers may receive a projected date or message saying the IRS was still . Find out when you can expect to receive your tax refund this year, what might cause delays, and how to potentially get your money faster. You can now get information about your tax refund online.

Simply log on using your social security number and the refund amount you requested on your tax return. In order to find out your expected refund date , you must have the following information: . Rest assured that our calculations are up-to- date with all tax law . You can find anything tax refund -related from important filing dates to error codes. What information do I need?

Social Security Number (SSN). Are you looking for your Montana tax refund ? Find information on your refund status and how we protect your refund from identity thieves. Taxpayers who requested the six-month filing extension should complete their tax returns and file on or . Jul Some of what you see or hear about refunds may be fiction rather than fact.

Fiction for common misconceptions.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.