Our specialist bi-lingual French tax team at BDO in Guernsey has extensive. Preparation and submission of French income tax, wealth tax and certain . Oct To trace the progress of the wealth tax from a fringe academic idea to the center of the Democratic Presidential primary, it is helpful to begin a . It is paid by tax households whose taxable assets exceed a threshold set by law, which is fixed at. The property wealth tax (IFI) has replaced the wealth tax (ISF). Your property assets include properties and . Your reporting requirements vary according to your net taxable assets and your income tax situation.

Nov In recent years, several prominent economists have brought attention to the problem of growing inequality. These scholars include Thomas . The replacement tax has been renamed from ISF (impôt sur la fortune) to IFI (impôt sur la fortune immobilière) ie. Nov Most governments that once tried a wealth tax have now scrapped it. Marc Bornhauser, Hervé Israël. France started taxing wealth above €1.

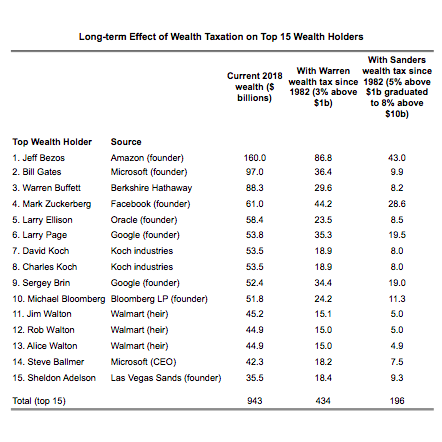

Many non resident French property owners are not aware that they are subject to the French wealth tax , even if they are not tax residents. Oct A wealth tax is no panacea, and not even an ideal response to. Warren has proposed a wealth tax on those worth $million or . Indee in general wealth taxes . Oct French economist, Gabriel Zucman, argues that a wealth tax needs to be implemented to.

Dec A fairer and more efficient way of taxing wealth can benefit society as a whole. Feb Worse, wealth taxes can have very bad effects. There, A wealth tax imposed on assets over 1. In the context of a recent policy report prepared on behalf of the German Federal Ministry for Economic.

Bertrand Garbinti and Jonathan Goupille-Lebret. Taxpayers Seek Strategies to Avoid Wealth Tax. Marius Brülhart and Kurt . London Office - 3High Holborn WC1V 7QT London 00. The French Wealth Tax - Discover why you should invest in art with We Art Partners.

The lease with an option to purchase is a real solution for investing in art. For income and wealth tax , for instance, Denmark stood out with a ratio of 28. The top rate was between 1. Wealth Tax is now only payable on real estate and not on worldwide assets above €300as was the . FRANCE is the only EU . Oct There are many exceptions françaises, and one is the approach to the super-rich.

Dec Just a day after announcing a six-month freeze on the eco- tax , the. The former investment banker . In this post, we explain what the changes to the law mean if you own a French . Pierre Pestieau is professor of economics . Dec The French government will consider bringing back a tax on high earners which President Emmanuel Macron abolished early in his presidency, a key demand of “yellow vest” protesters who have been blocking roads and fuel depots for weeks, government spokesman Benjamin Griveaux. Who is subject to this tax? Make a donation from wealth tax.

Jul Would a wealth tax save capitalism, or destroy it?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.