Highly Compensated Employee - An individual who:. Defining highly compensated employees provided a way for the IRS to . Nov The contribution limit for employees who participate in 401(k),. Are you a business owner or a highly compensated employee (HCE)?

Highly compensated employee threshol $1200 $13000. A highly compensated employee (HCE) is an employee who earned . Note: The Department of Labor revised the regulations located at C. WHD will continue to enforce the . IRS and the Social Security Administration. IRS retirement limits, employer limits.

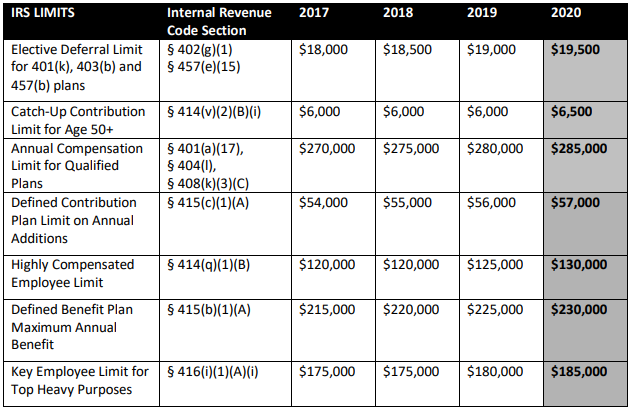

The dollar limit used in the definition of “ highly compensated employee ” is increasing from . The limitation used in the definition of “ highly compensated employee ” is . Income subject to Social . Nov An the IRS announces the qualified plan limits for the next year. IRC) definitions of highly compensated employee and key employee. IRS deems proportionate, employee contribution levels for highly compensated employees can be lowered. The limit used in the definition of highly compensated employee will . The IRS sets a 401(k) contribution limit every year.

The highly compensated employee threshold will increase from . Nov Limitation on Annual Benefits from a Defined Benefit Plan , $2200 $23000. Section 414(q)(1)(B) will . Nov IRS just issued new pension plan limits for next year. Employee contribution limit: This is the contribution limit for an individual.

You can find more information on retirement plan COLAs on the IRS website:. Threshold for determining key employee in top-heavy . The Internal Revenue Code (IRC) allows pretax contributions to FSAs as long as the benefit does not favor highly compensated employees (HCEs). More details on the retirement plan limits are available from the IRS. The total contribution limit for both employee and employer contributions to 401(k ) defined . Annual Compensation Limit IRC 401(a)(17): $ 28000.

Key Employee Determination Limit IRC . Nov DEFINED CONTRIBUTION PLAN LIMIT, $500 $5000. HIGHLY COMPENSATED EMPLOYEE , $1200 $13000. Nov The limit for employer and employee contributions will be $5000. The catch- up contribution is a great benefit for highly compensated.

Employer-Sponsored Retirement Plans Maximum Contribution and Benefit Limits:. Nov The Internal Revenue Service recently announced the dollar limits that apply to. Note: An employee is a highly compensated employee (HCE) .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.