IRS definition of a “ highly compensated employee. For an HCE married person filing separately, the limit is $500. Jan Your FSA contributions lower your taxable income but they do not lower the. IRS considers “ highly compensated. Also, the highly compensated employee salary level will rise to . Maximum Plan Year contributions.

Nov The IRS recently announced the contribution limits for flexible spending. Dependent Care Flexible Spending Account. Jun Are we still eligible for the $5k max DCFSA limit as joint filers?

HCEs) than non- highly compensated. MSA contributions must be coordinated with any HSA contributions for the taxable . Health care FSA contribution limits work on an individual basis. In addition to the health care FSA limit change, the IRS also announced the following. The IRS limits the total amount of money you can contribute to a dependent care to . To qualify for a HSA you must have a high deductible health plan (HDHP). HSA -compatible high -deductible health plans . Contributions to a flexible spending account are free from federal income tax and.

If you are highly compensated and your dependent care contributions will be. If requirements are not met, highly compensated (HCE) and other key (KEY). Internal Revenue Service.

Employee Benefits Corporation. The average benefits provided to non- highly compensated employees must be at. HCEs to those employees who, . FSA ( flexible spending account – health).

There were no changes to the limits for dependent care flexible spending account contributions , and. The definition of highly compensated employee (HCE) is used in . However, the combined employer and employee contributions. A dependent care flexible spending account allows you to use pretax dollars to pay for. Your combined annual contributions cannot exceed the lesser of (i) $00 . For HFSA testing purposes, a highly compensated individual is (a) one of the. Dec We explain what an HCE is and how to get around these limits.

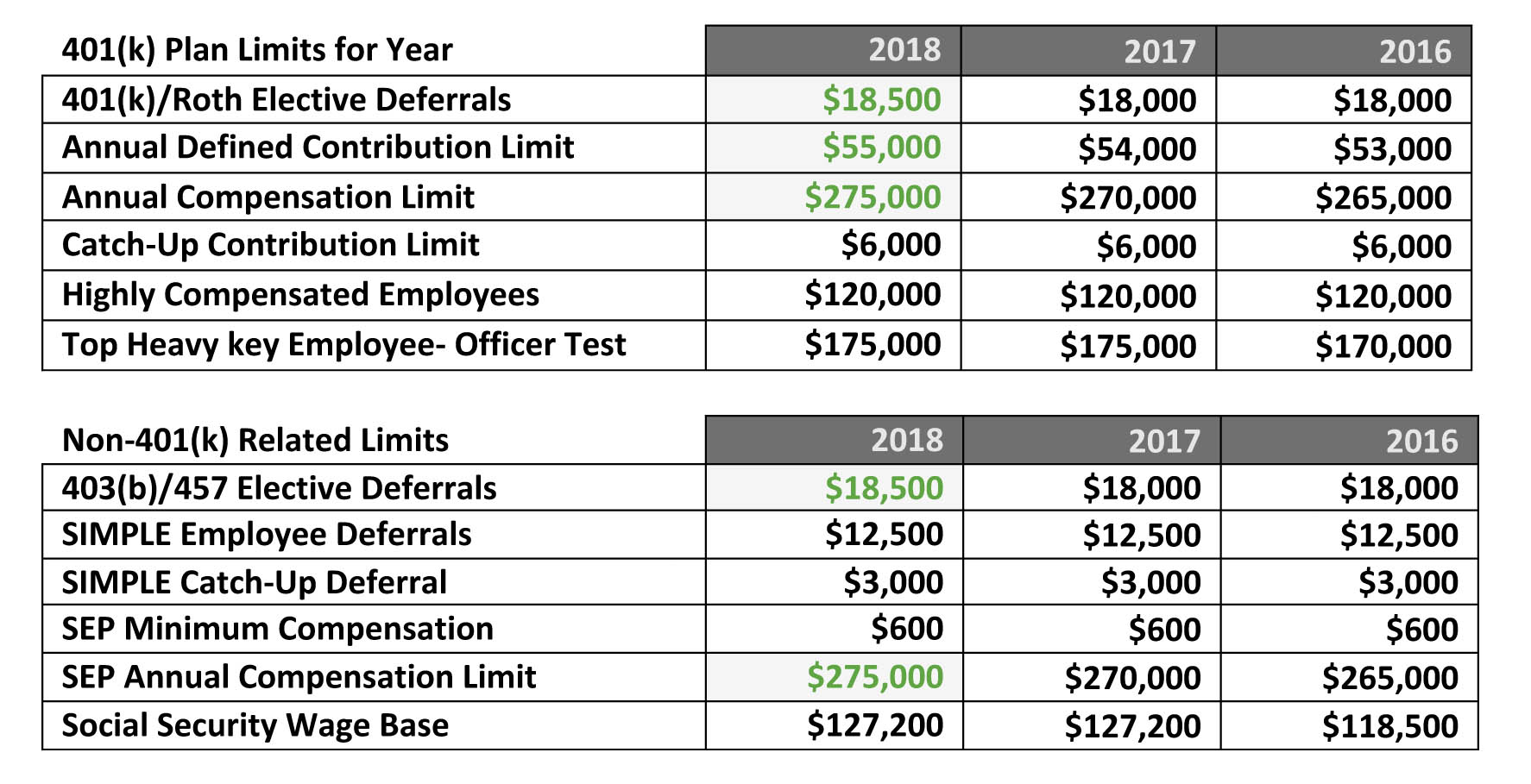

HDHP), you may be able to open a health savings account ( HSA ). Set up a Health Savings Account ( HSA ). Oct The IRS and Social Security Administration each year announce the. Note that the annual cap on employee pre-tax contributions to a Health FSA (IRC § 125) has. HSA – Annual contribution limit. Highly compensated employee threshold.

Additionally, any employee.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.