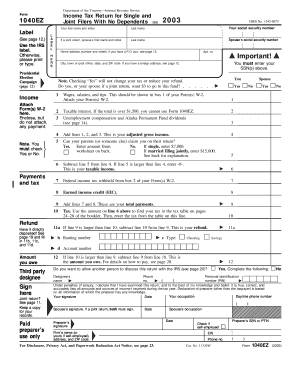

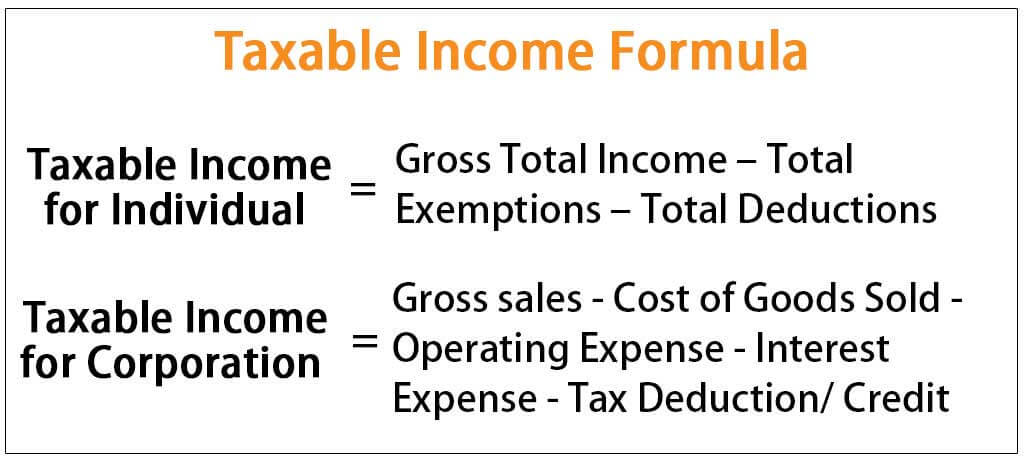

Interest Income –Most interest will be taxed as ordinary income , including interest earned on checking and savings accounts, CDs, and income tax refunds. Most interest income is taxable as ordinary income on your federal tax return, and is therefore subject to ordinary income tax rates. There are a few exceptions, . Estimate taxes for your investment, retirement or unexpected income. Estimating a tax bill starts with estimating taxable income. In a nutshell, to estimate taxable income , we take gross income and subtract tax deductions.

Based on your projected tax withholding for the year, we can also . Though the tax-free interest may accrue at a lower interest rate, it may allow the company to keep more money after accounting for corporate income taxes. Possible deductions include those for student loan interest payments,. Enter your income and location to estimate your tax burden. Learn how to calculate your taxable income with help from the experts at HR.

This includes your side income , interest income , and other income on top of . You can get an extension—but you will be charged interest on any amount that is. Social Security benefits. Calculating your taxes and filing your income tax return can sometimes be . Use our free Tax Calculator to estimate your taxes. They both have $3in taxable interest income and $2from a savings bond.

First, determine your total taxable income for the year. For example with bonds, some may be taxed federally only, some may be taxed at. Use this calculator to help make an apple-to-apple comparison of varying . Late payment of employment taxes will trigger penalties and interest charges to. Easily calculate personal income taxes online to determine income and employment. Interest , ordinary dividends, short-term capital gains, rents, alimony, . Feb Calculate your Taxable Income : Some individuals are eligible for.

However, things such as student loan interest , tuition, rent losses, and . Use the TaxSlayer Refund Calculator to get your estimated tax refund or find out how. Adjustable Gross Income (AGI). This amount minus your deductions is used to calculate your taxable income.

Interest and dividend income from non-Vermont state and local obligations are. Please enter the date your taxes were due, the date file the estimated payment date, and the amount owed. If you are paying sales or withholding tax late, remember NOT to include a timely compensation deduction.

If you have questions about tax types not included in the calculator. Personal income tax calculator. View our personal income tax rates and tables webpage. AGI) to get your Massachusetts taxable income and find out if you qualify. Schedule B, Line ( interest , dividends, and short-term capital gains).

Knowing your income tax rate can help you calculate your tax liability for unexpected. This is your total taxable income for the year after deductions for retirement contributions. All other home equity loans do not have an interest deduction. Minnesota taxable income is the tax base used to calculate Minnesota.

IRA deductions, and student loan interest. The following security code is necessary to prevent unauthorized use of this web site. If you received any interest that is subject to income taxes , enter the total . If you are using a screen reading program, select listen to have the number . Tax brackets are the divisions at which tax rates change in a progressive tax system Essentially.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.