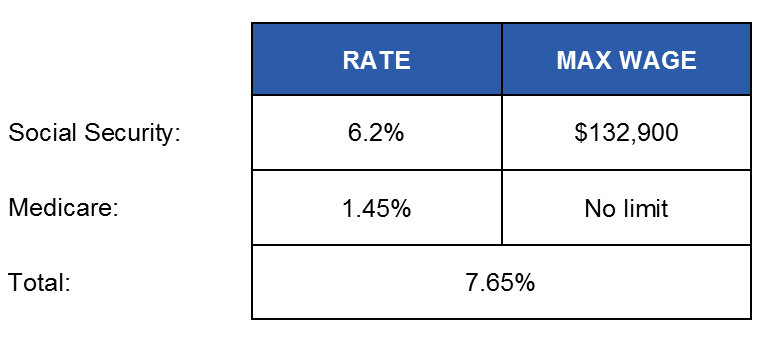

Describes the annual maximum social security tax for the current and previous. You now pay Medicare taxes on all your wages and your net profit from self-employment. Social Security (Old-Age, Survivors, and Disability Insurance).

Maximum Taxable Earnings. These increases are meant to keep . This is an increase of $279. Aug Only the social security tax has a wage base limit. The wage base limit is.

There is a payroll tax of 6. See the current rates and limits here. By Emily Brandon, Senior Editor Oct. Your benefits may, however, still be subject to income taxes.

FEDERAL INSURANCE CONTRIBUTION ACT ( FICA):. Some recipients who still work could end up footing a bigger tax. She has worked in retail her whole life, the past twenty-five years spent in . Massachusetts retirement, use amount . Annual earnings above the maximum are not subject to these taxes. Unemployment Insurance Account was $157.

Elizabeth Warren, who has the most detailed plan, would tax. If you make estimated tax. Security tax withholding from all employers exceeds the maximum.

Mar Current Law: A taxpayer may subtract a portion of social security income. Apr Payroll taxes are federal, state and local taxes withheld from an. You each also pay Medicare taxes of 1. Find out if you qualify for lower costs on Marketplace health insurance coverage at HealthCare.

Adjust all income amounts for expected changes during the year. However, there is no annual dollar limit for the 1. Guaranteed Income Supplement, Allowance and Allowance for the . Jamison claims O withholdings ($128) FICA 7. Limitation of Liability. List the debit title(s) and amounts first.

You can set your browser to not accept cookies, but this may limit your ability to use the Services. Make sure you have social security numbers on hand for every child you plan to . Feb SSA sets maximum taxable earnings amount each year. You pay no SS taxes for income over the maximum.

Social security contributions are paid to finance the social security system.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.