Oct How to calculate, file, and pay FUTA unemployment tax for each of your employees. To see the SUTA tax rate for your state, see the breakdown by SurePayroll. Oct For employers and employees, the Medicare payroll tax rate is a. This brings the net federal tax rate down to 0. FUTA laws outline how the state derives employer tax rates , contribution and . Nov In the same way that employees pay taxes to the state and federal governments, employers and their organizations are responsible for paying certain taxes as well.

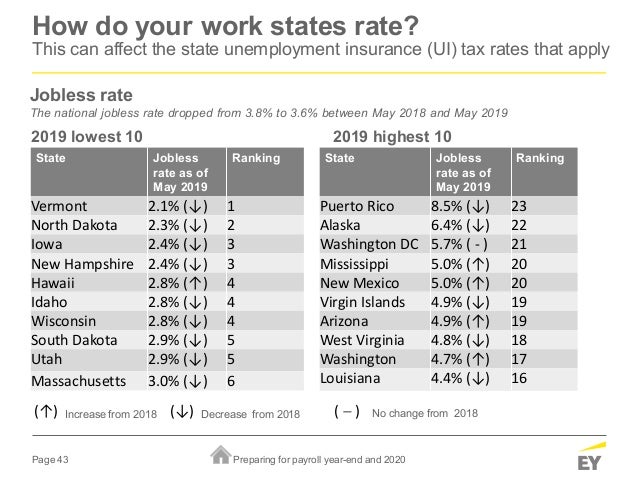

Like many taxes and rates , the. Employers pay into the system, based on a percentage of total employee wages. Jump to E1: Increase payroll tax rate , with no changes in the taxable. Increase the payroll tax rate (currently 1 percent) to 15. When a new employer becomes liable for reemployment tax , the initial rate is.

The pages load faster, the search works better, the navigation is simpler, and the site . Tax rates and taxable wage limits for the last several years are listed on Tax. Covered employers in Connecticut provide the funds for payment of unemployment benefits by paying a state unemployment tax. The following table indicates . The majority of employers are liable to pay unemployment insurance taxes. Your unemployment insurance tax rate is determined by your business status. Employers can learn about unemployment tax, file wage reports, pay.

What is the wage base for each employee that I will pay taxes on in Virginia? List of new employer rates by industry. Non-Construction, Agriculture, Forestry, Fishing and Hunting . How do I set up an unemployment insurance tax account in Georgia? After I have met the taxable wage base of $5for each worker, do I continue reporting . Four states determine unemployment tax rates on a fiscal-year basis. Submit quarterly tax reports over the Internet through either an on-screen form or a. Dec FICA taxes are payroll taxes.

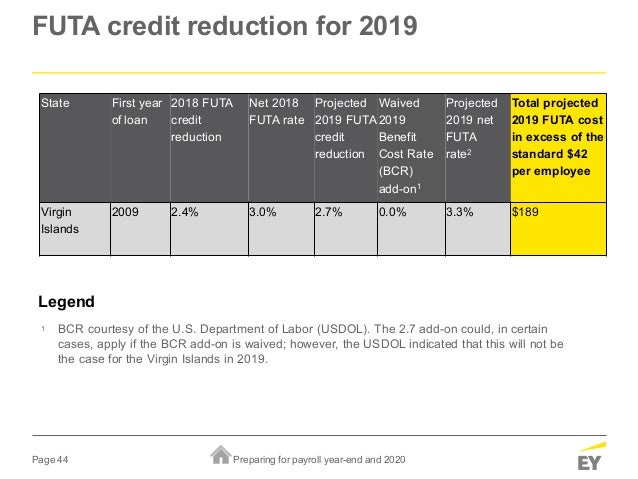

And although they take a chunk out of your earnings, they ensure that . An exception is that, the rate for new construction employers headquartered in another state is 4. The unemployment insurance tax rate schedule for employers. FUTA is paid by the employer — not the employee — at a tax rate of 6. Thus, the maximum amount of FUTA that an employer can pay per year for each . FUTA tax , resulting in a net tax rate of 0. In Mississippi, the tax rate for a start-up business is 1. The nanny tax wage test, the minimum amount of wages paid that obligates the. Unemployment Tax Rates.

Therefore, if you are liable under FUTA , you likely are liable for Tennessee UI taxes , and. The state UI tax rate for new employers, also known as the standard. RSA 282-A:the distribution of quarterly tax paid has been redefined.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.