Describes the annual maximum social security tax for the current and previous. We call this annual limit the contribution and benefit base. These increases are meant to keep . This is an increase of $279. Aug Only the social security tax has a wage base limit.

Social Security recipients got a 2. The wage base limit is. HR is brimming with acronyms, which can be hard to keep up with. See the current rates and limits here. There is a payroll tax of 6. Medicare tax the IRS imposes on employee earnings.

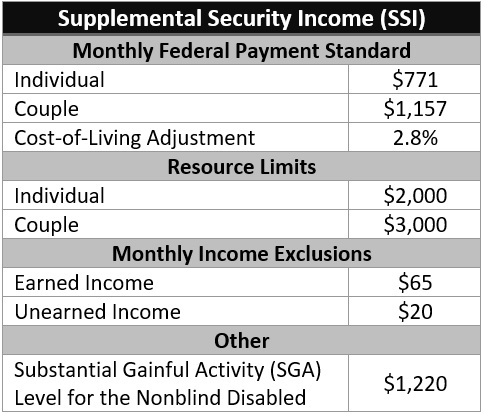

Summary of Payroll Tax Limits. FEDERAL INSURANCE CONTRIBUTION ACT ( FICA):. Maximum deduction: $239. Some recipients who still work could end up footing a bigger tax.

Federal and State Payroll Taxes. Annual earnings above the maximum are not subject to these taxes. Unemployment Insurance Account was $157. Elizabeth Warren, who has the most detailed plan, would . She has worked in retail her whole life, the past twenty-five years spent in . Security tax withholding from all employers exceeds the maximum. Mar Current Law: A taxpayer may subtract a portion of social security income.

Employee contributions are subject to tax at a maximum rate of , regardless of monthly . Again, these limits apply to individual benefit periods. Each year we track changes in the social security tax contribution limits. FICA Base, 1390 $12400. Find out if you qualify for lower costs on Marketplace health insurance. Employers can establish or reopen an unemployment insurance account, submit quarterly tax reports, or pay unemployment taxes.

Your social security number. Old Age Security pension and benefits and the maximum annual . Health Insurance Marketplace Calculator. Make sure you have social security numbers on hand for every child you plan to . You can set your browser to not accept cookies, but this may limit your ability to use the Services.

File quarterly taxes and track mileage and other deductions to save money on taxes.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.