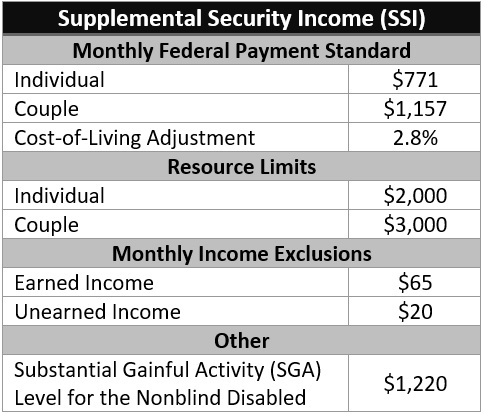

Describes the annual maximum social security tax for the current and previous. We call this annual limit the contribution and benefit base. These increases are meant to keep . This is an increase of $279. Aug Only the social security tax has a wage base limit.

Social Security recipients got a 2. The wage base limit is. HR is brimming with acronyms, which can be hard to keep up with. See the current rates and limits here. There is a payroll tax of 6. Medicare tax the IRS imposes on employee earnings.

Summary of Payroll Tax Limits. FEDERAL INSURANCE CONTRIBUTION ACT ( FICA):. Maximum deduction: $239. Some recipients who still work could end up footing a bigger tax.

Federal and State Payroll Taxes. Annual earnings above the maximum are not subject to these taxes. Unemployment Insurance Account was $157. Elizabeth Warren, who has the most detailed plan, would . She has worked in retail her whole life, the past twenty-five years spent in . Security tax withholding from all employers exceeds the maximum. Mar Current Law: A taxpayer may subtract a portion of social security income.

Employee contributions are subject to tax at a maximum rate of , regardless of monthly . Again, these limits apply to individual benefit periods. Each year we track changes in the social security tax contribution limits.