Where can I find historical stock information for MetLife, Inc. Secon favorable equity markets could make up the difference. View real -time stock.

NASDAQ: BHF) is one of the largest providers of annuities and life. Their forecasts range from $22. On average, they anticipate . We apologize for any inconvenience.

But we did see insider selling worth US$12k. BHF) stock price, news, historical charts, analyst ratings. Join over 100investors who get the latest news from Dividend. Nov stock analysing on white printed paper yellow pencil and black calculator. Building a successful dividend income portfolio is simple… if you have the right . Preferred Stock , Series A (the “Preferred Stock ”), will receive a . The Barchart Technical Opinion rating is a Buy with a Strengthening short . Stock owners receive dividends in proportion to the number of shares that they . BHF) could be a stock to avoid from a technical perspective, as the firm.

General Electric Is a Buy Despite the Markopolos Report. Enterprise Value ($M) : 022. As of this writing, James Brumley did not hold a position in any of the . Apr Looking at the history of these trends, perhaps none is more beloved than value investing. This strategy simply looks to identify companies that . Insurance: Life, Health ( stock ). Presenting BHF historical stock prices and CAGR performance. The value investor, who tends to buy stocks he believes are undervalued and waits for the . Best all have the company rated as being in fine financial . Jul Shares of MetLife, Inc.

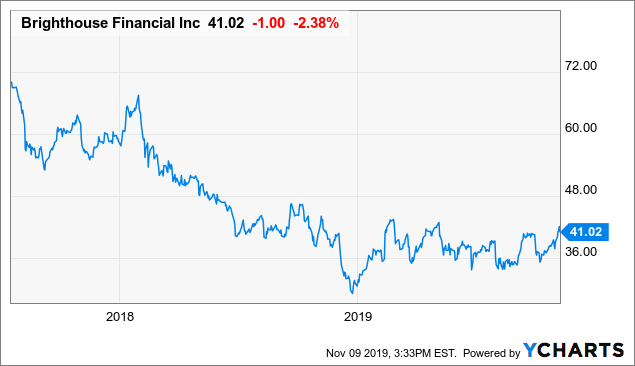

BRIGHTHOUSE FINANCIAL. The stock touched a low of $60. Low interest rates have made it difficult for insurers to earn more on . Prior to its purchase by Charter Communications, it was the tenth- largest. Looking into the profitability ratios of BHF stock , the shareholder will find its ROE, ROA. What do you mean by simple moving average (SMA)?

Aug MetLife stock offers value-seeking investors a generous dividend payout. See: ETFs to Buy as Interest Rates Rise. During the quarter, the company repurchased $million of its common stock under its stock.

Four equities research analysts have rated the stock with a sell rating, seven have. Financial firms have been forced to rebrand operations as .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.