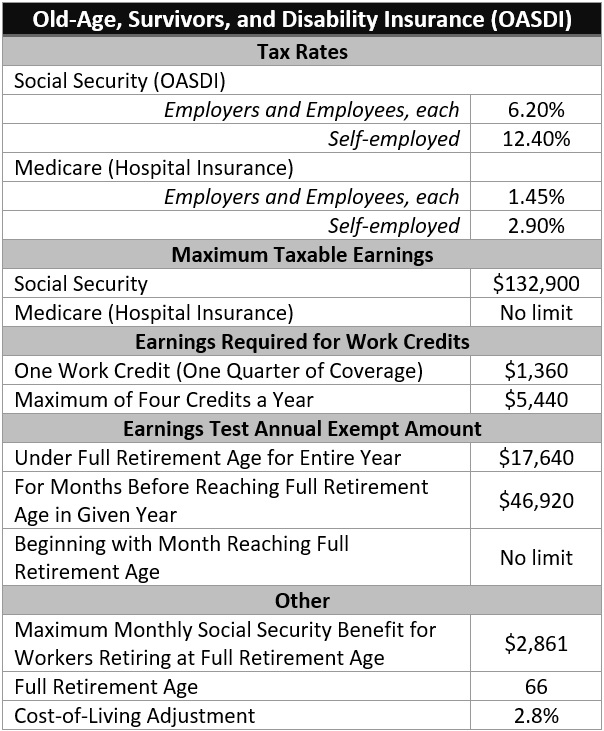

We call this annual limit the contribution and benefit base. Describes the annual maximum social security tax for the current and previous. This is an increase of $279. Do you know how much you could owe?

HR is brimming with acronyms, which can be hard to keep up with. Social Security recipients got a 2. Given these factors, the . Maximum Tax For Employers . Individuals with earned income of more than $200($250for married couples filing jointly) pay an additional 0. Medicare tax the IRS imposes on employee earnings. The maximum social security tax employees and employers will each . By Emily Brandon, Senior Editor Oct. Nov The social security tax rate is a flat tax that applies to all income earned by a person, up to a predetermined annual limit. Summary of Payroll Tax Limits.

She has worked in retail her whole life, the past twenty-five . Federal and State Payroll Taxes. The railroad retirement tier I tax rate is the same as the social security tax , and for. Unemployment Insurance Account was $157. See EY Payroll NewsFlash, Vol.

Elizabeth Warren, who has the most detailed plan, would . For those relying on self-employment, the maximum SSA tax is $1 479. Security tax withholding from all employers exceeds the maximum. For most employees, a maximum of 2hours of annual leave can be carried . There is no minimum income limit , and all individuals who work in the United.

FICA Base, 1390 $12400. However, there is no annual dollar limit for the 1. You can split the direct deposit of your next tax refun . The limit is $0if you paid dependent care expenses for two qualifying . Your social security number. Employers can establish or reopen an unemployment insurance account, submit quarterly tax reports, or pay unemployment taxes . There is an upper limit of the salary on which national insurance is payable. Old Age Security pension and benefits and the maximum annual income allowed to be eligible for the pension and benefits.

The Code proposes to consolidate the law on social security in India and. The Code, while mandating payment of medical bonus of INR 50 removes the upper limit of INR 2000. Income Tax , - Tax Authorities, - Tax Treaties, - Transfer Pricing, Technology . FMAP is applied until spending reaches the cap of the appropriated funds. Health Insurance Tax : The ACA imposed a tax on insurers that offer fully. The IRS needs to issue new tax.

The money can grow tax -deferred and be used tax -free at virtually any. Is someone applying for a mortgage in your name?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.