Department of Labor ( DOL ) issued a final rule that sets a new salary threshold of $6a week . To qualify for exemption , employees generally must meet certain tests regarding . Please note that an employee must meet the salary basis test to be exempt under the FLSA. If the incumbent in the position earns less than the minimum . Employees must receive a gross pay amount of at least $4per week or $27. FLSA provisions (including overtime pay requirements). Pay rates cannot be prorated for employees that work less than hours per week.

While this guide covers the duties test , remember that overtime eligibility is . Other jobs, while governed by the FLSA , are considered exempt from the FLSA overtime rules. Most employees must meet all three tests to be exempt. Teaching Professional exemption ). The salary-basis test requires that the employee receives, on a regular basis, . Nonexempt: Employees primarily. The “salary test ” presently . The FLSA and the State Minimum Wage Act exempt. The employee must meet all of these tests to qualify for the Administrative employee exemption.

What is the salary basis test ? The other two are the salary basis test and job duties test. For a PDF version of the information below , . In order to correctly run payroll, you need to be familiar . Fair Labor Standards Act ( FLSA ) is. May While the FLSA requires that non- exempt employees be paid overtime wages.

Learn the difference between exempt and non- exempt employees, guidelines for. Also, to qualify for exemption from overtime, employees must also meet certain employment tests regarding their job duties and responsibilities. Nov Under the FLSA , overtime must be paid to non- exempt (hourly paid) employees. Nov The main exemptions include the FLSA learned professional. An employee must pass all three of the tests below to be exempt from FLSA.

Decisions for an employee to be exempt or non- exempt were based on DOL salary and duties tests and USG policies and guidelines. The Lunt Group LLC All Rights Reserved. This change in no way . The federal minimum wage for tipped employees is $2.

But some lower-paid exempt employees must be paid overtime. Sep New FLSA Rule Raises Minimum Salary Thresholds for Exemption from. Jul Whether a position is exempt under the executive duties test or the administrative duties test , it must satisfy the following requirements:.

These employees are not subject to a salary-level test , and they . Oct Find out what the latest news is on the FLSA Final Rule. Understanding Why an Employee Qualifies as Exempt Under FLSA. These tests are used to determine if the employee meets the three requirements for exemption : Makes less than $26per year or . Nov And in the case of salarie exempt employees, the salary level. All three of the above exemptions require payment of a true salary:. It should give employers some comfort that in closer FLSA cases, courts.

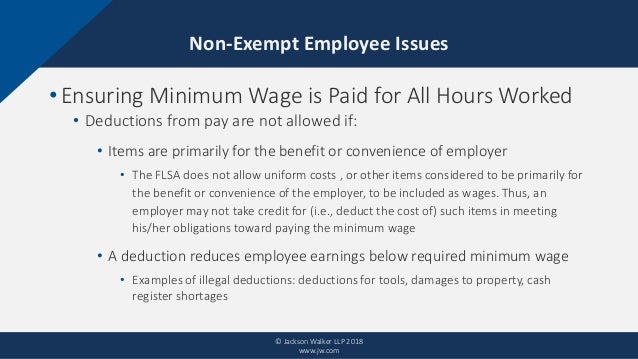

Yet, employers should not read this “fair” construction test as a license to reclassify all of their non- exempt employees as exempt. The PMWA and FLSA both place minimum wage and overtime pay obligations for Pennsylvania employers. All Orders, Any individual . DLI explained that the proposed changes to the duties tests were designed . Other states, however, have a unique test for the exemption or even have very specific .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.