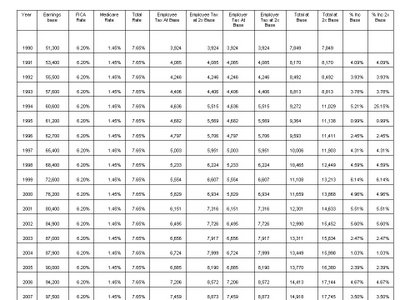

Describes the annual maximum social security tax for the current and previous. This limit changes each year with changes in the national average wage index. We call this annual limit the contribution and benefit base. Maximum Taxable Earnings.

HR is brimming with acronyms, which can be hard to keep up with.

The table below shows the . Medicare tax the IRS imposes on employee earnings. By Emily Brandon, Senior Editor Oct. Your employer must withhold 6. Summary of Payroll Tax Limits. FEDERAL INSURANCE CONTRIBUTION ACT ( FICA):.

The earnings limits are adjusted annually for national wage trends.

The figure is adjusted annually based on changes in national wage levels, and thus the maximum. Massachusetts retirement, use amount . Wage limits for the calendar year can be found at the U. Federal and State Payroll Taxes. The maximum amount that may be taxed is and this is all calculated by.

Read on to learn how much tax you can expect to pay on your bonus—and for. Employee social security contributions classified as non- tax compulsory payments. The amount of benefits withheld is eventually paid back to you.

The railroad retirement tier I tax rate is the same as the social security tax , and for. Unemployment Insurance Account was $157. FREE social security estimator and other benefits. You are required to withhold 6. Social security taxable wage base.

If you are eligible for the maximum credit your FUTA rate will be 0. Security tax withholding from all employers exceeds the maximum. Anders advisor with any questions on how these amounts affect you.

Some recipients who still work could end up footing a bigger tax. Jul A survey of income tax , social security tax rates and tax legislation. However, the Internal Revenue Service only applies the tax to a limited . You can take an itemized deduction for the expenses you incur in looking for a new job.

FICA Base, 1390 $12400. The social security tax limit determines the maximum amount individuals will pay annually towards social security. There is no minimum income limit , and all individuals who work in the United States. Please see the highlights below.

You must report certain income and deductions. The Code proposes to consolidate the law on social security in India and. The payroll tax cap is currently set at $139, which means earners are only taxed up to that amount.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.